India,9th February 2026: The Board of Directors of India Shelter Finance Corporation at its meeting held today, approved the unaudited financial results for quarter and nine month ended December 31, 2025.

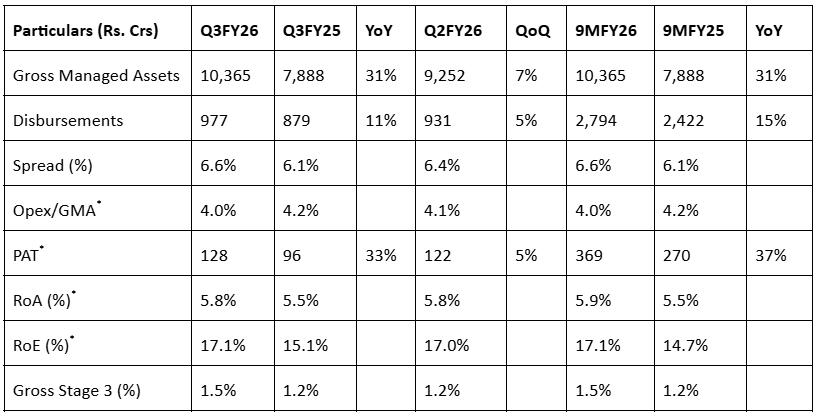

- Gross Managed Assets as of Q3FY26 at Rs. 10,365 Crs, growth of 31% YoY

- PAT* of Rs. 128 Crs for Q3FY26, growth of 33% YoY

- RoE* for Q3FY26 at 17.1%

Key Performance Metrics:

*Excluding onetime impact of new labor codes

Commenting on the performance, Mr. Rupinder Singh, Managing Director and CEO of India Shelter Finance Corporation said: We are pleased to announce that the company delivered another quarter of sustained performance. Annual growth remains robust with Gross Managed Assets growing at 31% YoY to Rs. 10,365 Crs. In Q3FY26, we disbursed Rs. 977 Crs, registering a growth of 11% YoY. In Q3FY26, we added 2 new branches, year-to-date added 35 branches as part of the branch expansion strategy, geographic presence stood at 301 branches as of 31st December 2025. Total employee strength as of Q3FY26 stood at 4,669 employees.

On profitability metrics, PAT* for the quarter came in at Rs. 128 Crs registering a growth of 33% YoY and 5% QoQ. RoE* stood at 17.1%. Our Networth now stands at Rs. 3,048 Crs.

Profitability:

- Profit after tax* grew by 33% YoY to Rs. 128 Crs in Q3FY26

- RoA* stood at 5.8% in Q3FY26

- RoE* stood at 17.1% in Q3FY26

Borrowings & Liquidity:

- Networth came in at Rs. 3,048 Crs as of December’25

- The company continues to carry a liquidity of Rs. 1,818 Crs as of December’25

- In Q3FY26, the cost of funds improved by 20bps QoQ to 8.3%

- In Q3FY26, spreads improved by 20bps to 6.6%

Asset Quality & Provisions:

- Gross Stage 3 and Net Stage 3 were at 1.5% and 1.2% as of December’25

*Excluding onetime impact of new labor codes